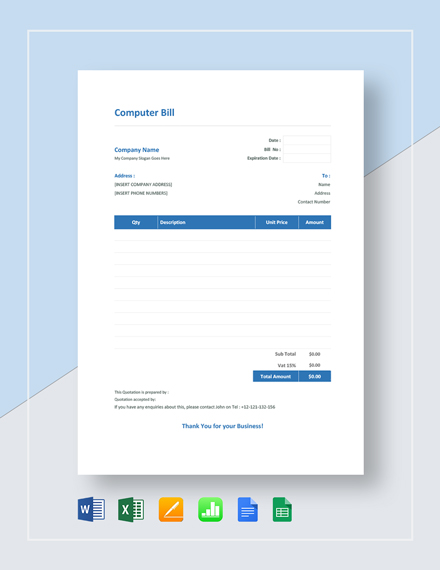

- #Computer bill format serial number

- #Computer bill format professional

- #Computer bill format download

- #Computer bill format free

In case of cessation of supply of services, According to Section 31(6), Where a supply of service ceases under a contract before the completion of the supply, the invoice shall be issued at the time when supply ceases and such invoice shall be issued to the extent of the supply made before such cessation. (b) Six months from the date of removal of goods by the supplier In case of supply on approval basis, according to Section 31(7), the invoice shall be issued, (c) In case of events are fixed in the contract, then the last date of completion of such event. (b) If the due date is not ascertainable then the date of payment received. (a) If the due date is ascertainable in the contract, then on such date. In case of continuous supply of services, according to Section 31(5), the invoice shall be issued on or before, In case of continuous supply of goods, according to section 31(4), the invoice shall be issued before or at the time of, Special Provisions relating to different cases Normal Provisions relating to the issue of GST invoiceĪccording to Section 31(1), a GST invoice should be issued on or before if the movement of goods involved at the time of removal and in other cases at the time of delivery of goods or goods made available to the customer.Īccording to Section 31(2), GST invoice should be issued on or before the provision of services but not beyond 30 days after completion of services and 45 days in case of Banks, Financial institutions, Nonbanking financial companies, and Insurer. Time of Supply is different in goods and services and in reverse charge cases. Time of Supply of an Invoice in case of goods and services It is the time up to which an invoice should be issued and such date would be counted as the time when tax becomes payable to the government. The time of supply is the most important factor to be considered regarding the issue of an invoice. Now let us understand important concepts, regarding GST invoices issuance in the case of a supply of goods and services and in other cases. 200 then no need to issue a tax invoice in case of Business Consumer transactions. In case of the value of goods and services or both supplied is less than Rs. Once the invoice is issued as per GST law, GST is payable even if no payment is received from the recipient. 2.5 Lacs a consolidated revised tax invoice may be issued separately in respect of all unregistered recipients located in a state. In the case of inter-state supply, where the value of a supply does not exceed Rs.

#Computer bill format serial number

(e) Other details of Unregistered recipient.Ĭonsecutive serial number should not exceed 16 characters for a tax invoice and one or multiple series shall be maintained for the financial yearĪ consolidated revised tax invoice can be issued for all taxable supplies made to an unregistered person. Designed for small businesses, this system helps you get paid fast using great-looking invoice templates and online payments.Ĭhoose from our wide range of templates of invoices to make your billing statements better.(d) Name, Address & GSTIN/UIN of the recipient.

#Computer bill format download

You can even download an invoice template that lets you sign up for Microsoft invoicing. You’ll also find invoicing templates and billing statements that deduct deposits or provide tax calculations. With service-specific templates for an invoice, you can enter quantities and unit costs for labor and sales and even adjust the invoice template to double as a receipt. Sales invoicing templates itemize purchases and can calculate totals and special discounts automatically.

#Computer bill format free

Easy-to-use and professionally designed, these free invoice templates streamline your administrative time so you can get back to running your business.Įxcel and Word templates for invoices include basic invoices as well as sales invoices and service invoices.

#Computer bill format professional

Professional invoice templates to streamline your business billingīilling is a breeze with a Microsoft invoice template.

0 kommentar(er)

0 kommentar(er)